The Peloton Brief: Margin in Falling Markets

Although Peloton is falling out of favor as the world reopens and people return to a new version of whatever “normal” has become, I am still a loyal fan. Cody Rigsby’s fast food rants and 90s nostalgia have powered me through many days of cross-training or poor air quality and prenatal yoga has (knock on wood) so far kept my body from falling apart.

Peloton has been in the news lately for other reasons, most of which have to do with the company’s mismanagement, layoffs, and uncertain future. Most recently, the Wall Street Journal reported last week that Peloton stock’s (PTON) slide has led to John Foley, Peloton’s founder, maxing out pledged shares to cover margin calls. He was not alone, as co-founders Thomas Cortese and Hisao Kushi have also pledged a significant portion of their Peloton shares as collateral for personal loans.

Margin accounts may present previously unexplored complications for wealthy investors and younger executives who are navigating their first major market downturn since moving into corporate leadership.

With markets down almost 20% YTD, and many previously high-flying tech companies down much further (including Peloton, down 80% since January), individuals and families who borrow or invest on margin may be navigating new and uncertain waters.

In this article, I’ll use Peloton’s example to help you understand margin and explain what it is and how to use it. I’ll also cover the dangers of using margin in falling markets and what to do when you get a margin call.

Peloton executives demonstrate the dangers of margin debt in falling markets

John Foley, Peloton’s former CEO, and Thomas Cortese and Hisao Kushi, co-founders, have each pledged a significant portion of their Peloton shares (40%, 25%, and 25% respectively) as collateral for personal loans.

Over the past years, Foley, Cortese, and Kushi each took out personal loans on margin that were secured by a portion of their overall Peloton holdings. As Peloton’s share price fell, the value of the holdings used to secure these personal loans shrank to the point that they were no longer sufficient to cover the bank’s liability for the loan. When this happens, it triggers what is known as a “margin call” - the lending institution requires you to deposit a specific amount of cash or additional equity within a set period of time (anywhere from immediately to 1-5 business days) or they will sell a portion of your margined equity to cover your loan obligation.

Generally, investors want to avoid their margined equity being sold and instead deposit cash or margin additional equity as quickly as possible. This is the situation John Foley found himself in - as Peloton’s shares plunged 80% over the past 10 months, he faced repeated margin calls on his loan balances that ultimately forced him to pledge 41% of his total equity in Peloton. It has been speculated that this is one of the reasons Foley stepped down from a leadership position at Peloton, which limits its executives and board officers from pledging more than 40% of their total Peloton position as collateral for personal loans.

Many investors use margin in a similar way to John Foley - as a way to access ready cash for personal loans. These investors may find themselves in a similar, unenviable position as they face repeated margin calls in the face of stock market losses.

Borrowing on margin is attractive because, as a secured loan, rates are generally much lower than what you could get with a personal loan. However, borrowing on margin is also a risky proposition. It is best to make withdrawals prudently and bear in mind the margin requirements of your lending brokerage.

Let’s use the example of an individual who has a $10,000,000 brokerage account and would like to take a loan on margin:

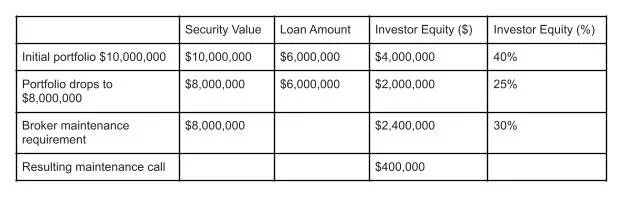

This individual’s brokerage firm has a 30% maintenance requirement for equity securities.

If at any time the account’s value minus the loan value is less than 30% of the total account’s value, it will trigger an immediate maintenance call for an investor to deposit cash or marketable securities or their holdings will be sold.

Using the chart below as guidance, suppose this individual took a 6,000,000 margin loan in January 2022, putting them $1,000,000 above the 30% maintenance requirement (10,000,000 - 6,000,000 = 4,000,000 versus a maintenance requirement of $3,000,000).

Over the past 10 months, this individual's account has lost 20% of its value, or $2,000,000. Their account is now worth $8,000,000 and has a margin maintenance requirement of $2,400,000 ($8,000,000 * .3). They are now below the maintenance requirement ($8,000,000 - $6,000,000 = $2,000,000) and will trigger an immediate margin call for $400,000.

If this individual does not respond by wiring funds or adding marginable securities to their account immediately, their brokerage firm will choose positions to sell at their sole discretion. This would be disastrous for this individual, as the account is made up of gifted securities that have a very low basis and any sales will result in a significant tax bill. The borrower in question should make every effort to come up with cash to satisfy this margin call and start creating a plan to reduce their overall margin balance and avoid additional maintenance calls in the future.

Using margin for personal loans has pitfalls, but it can be an effective tool for shorter duration loans that are well below the threshold that would trigger a maintenance call, even with a 30% market drop.

Taking personal loans with margin is the best used for short-term cash needs, such as when you are waiting for proceeds from the sale of a house to arrive but need funds to make a down payment on a new property. Lower rates on margin loans are attractive, and shortening the duration of margin transactions limits your overall risk exposure to market movements, although it doesn’t completely eliminate risk.

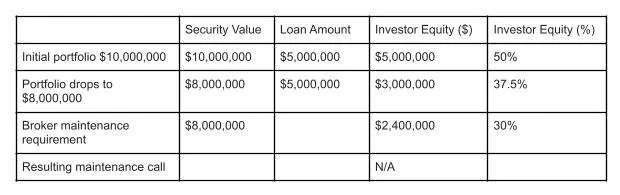

The most important risk-management principle when borrowing on margin is to borrow a percentage of your portfolio that is well below what may trigger a margin maintenance call.

In the example above, if our investor had borrowed $5,000,000 instead of $6,000,000 they would have been protected from a maintenance call even with a 20% market drop ($8,000,000 - $5,000,000 = $3,000,000, greater than the maintenance requirement of $2,400,000). I advise clients to borrow even less, advocating for a draw that would not trigger a maintenance call in the event of a 30% market drop.

When markets start to show signs of increasing volatility, those with margin loans should make a plan early to decide how they will deal with a potential margin call. If a maintenance call happens and you aren’t prepared, you are going to be in an “immediate action” situation.

This plan could include securing an alternate source of financing to reduce your margin balance in a pinch, or starting to stockpile cash in anticipation of a potential maintenance call. As the COVID-19 crash showed us in March of 2020, markets do not always flash months of warning signs before major drops occur. While this was not a typical event, investors should prepare for any eventuality before taking out a long-term margin loan.

If a maintenance call arrives and you don’t have a clear source of cash or additional equity to add to your portfolio, your options are

(1) take it on the chin and accept the consequences of your brokerage firm to selling what they will from your portfolio in order to meet the call, or

(2) quickly identify an additional source of liquidity to bring your account up to the required level.

Option #2 is preferred if possible, and becomes more essential when selling securities from your portfolio would create a tax burden. This additional liquidity might mean taking a short-term loan from friends or family, depleting your cash reserves temporarily, or working with your bank to quickly set up and draw from a line of credit.

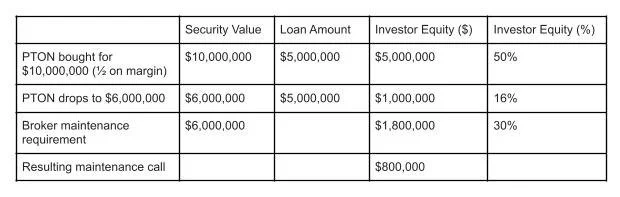

While the Peloton executives in question were using margin accounts for personal loans, many investors also use margin accounts to invest - borrowing money to leverage the purchase of additional securities. This is a potentially higher-risk endeavor that should only be attempted by seasoned investors who fully understand the risks involved.

Buying equities on margin is not unlike the process of taking a personal loan, although the inputs are different. Suppose you deposit $5,000,000 in a brokerage account and use your full available margin balance of $5,000,000 to purchase $10,000,000 of Peloton stock. With market declines, your $10,000,000 of PTON is soon worth only $6,000,000.

Your initial loan amount doesn’t change, so your investor equity has decreased to $1,000,000 ($6,000,000 - $5,000,000 = $1,000,000), down to 16% of your portfolio value. Your broker maintains a 30% equity requirement, which is $1,800,000 on a portfolio value of $6,000,000. This decline will result in a margin call of $800,000.

Buying on margin offers the opportunity to leverage your investments for additional growth. The above example demonstrates that it also comes with a high degree of risk and can create significant financial risk during periods of market volatility.

For investors with a significant stock portfolio, taking a personal loan from margin may be an appropriate opportunity. Margin loans should not be undertaken, however, without a thorough review of the risks entailed and the creation of a plan in case of an unexpected, significant market drop. Contact Katherine or schedule a call if you would like to talk more about options for margin loans or investing on margin.

About Sunnybranch Wealth

Sunnybranch Wealth is a boutique, fiduciary, fee-only financial advisory firm that works with progressive individuals and families who want to build their wealth while creating positive social impact.

Sunnybranch specializes in working with millennials and busy families who need help but don’t have time or energy to devote to their finances. We serve as your trusted resource and partner, alleviating the stress of managing your wealth and letting you focus on living your life.

Our founder, Katherine Fox, is a CERTIFIED FINANCIAL PLANNER™, Chartered Advisor in Philanthropy®, and 21/64 Certified Advisor with deep expertise and experience in helping clients build wealth while navigating life’s financial challenges. Her work combines comprehensive financial planning, ESG and impact investing, and charitable guidance to serve clients who want to grow their wealth sustainably while giving back in a meaningful way.